Saathi Svatantra Microfin, founded by Ananya Birla in 2012, has emerged as a leading technology-driven microfinance institution in India. This comprehensive guide covers everything you need to know about accessing and using Saathi Svatantra’s services, from logging in to managing your loans.

Also read – Profitable Future Business Ideas in India: Opportunities for 2025, 2030, and 2050

Table of Contents

About Svatantra Microfin

Saathi Svantra Microfin has revolutionized the microfinance sector through its innovative approach and commitment to digital solutions. As India’s first microfinance institution to implement 100% cashless disbursements since inception, the company has maintained its AA- rating, the highest in the sector.

Also read – Upcoming Startup IPOs in 2025: Indian Companies Preparing to Go Public

Following its acquisition of Chaitanya India Fin Credit, Svatantra has become the second-largest microfinance organization in India, managing an AUM of over 13,000 Crore with a workforce exceeding 17,000 employees.

Accessing Your Saathi Svantra Microfin Account

Login Process

To access your Saathi Svantra Microfin account, follow these steps:

- Visit the official website at www.svatantramicrofin.com

- Navigate to the login landing page

- Enter your credentials to verify your identity

- Access your dashboard to view loan status and account details

Note: Only authorized users with active Saathi Svatantra services can access the login portal.

Also read – Shark Tank India Judges Net Worth, Valuation, Education

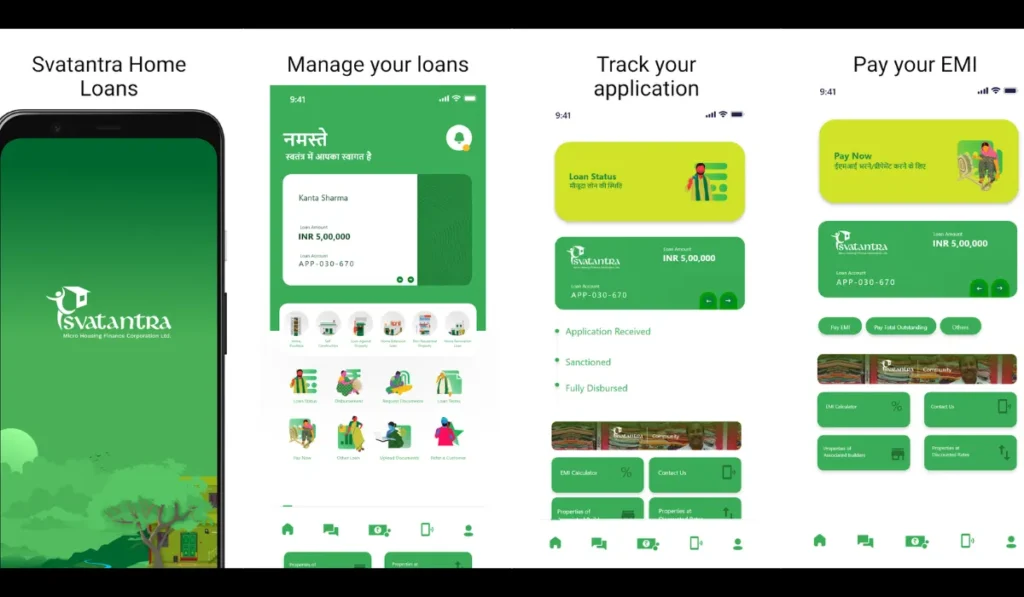

Digital Platforms

Saathi Svantra Microfin offers multiple ways to access their services:

- Website: www.svatantramicrofin.com

- Mobile App: Available on Google Play Store for Android users

- Customer-facing app: First in the industry to offer extensive digital services

How Svatantra’s Loan Process Works

Saathi Svantra Microfin follows a structured approach to provide financial assistance:

- Customer Identification: Detailed surveys to identify eligible loan beneficiaries

- Group Formation: Field officers create “Svatantra Sahayatah Samooh” groups of 5-12 members

- Financial Education: Comprehensive workshops on money management

- Application Assessment: Thorough evaluation of potential customers

- Fund Disbursement: Cashless transfer of approved loan amounts

- Repayment Support: Regular guidance and EMI collection assistance

Services and Products

Saathi Svantra Microfin offers various financial solutions including:

- Microloans for business expansion

- Insurance products

- Savings accounts

- Financial literacy programs

- Business development support

Also read – Leading Fashion Startups in India in 2025

Recent Developments

Saathi Svantra Microfin continues to grow and attract significant investment, demonstrating its strong market position and potential for future expansion. Their focus on technology-driven solutions and customer-centric approach has made them a preferred choice for microfinance services in India.

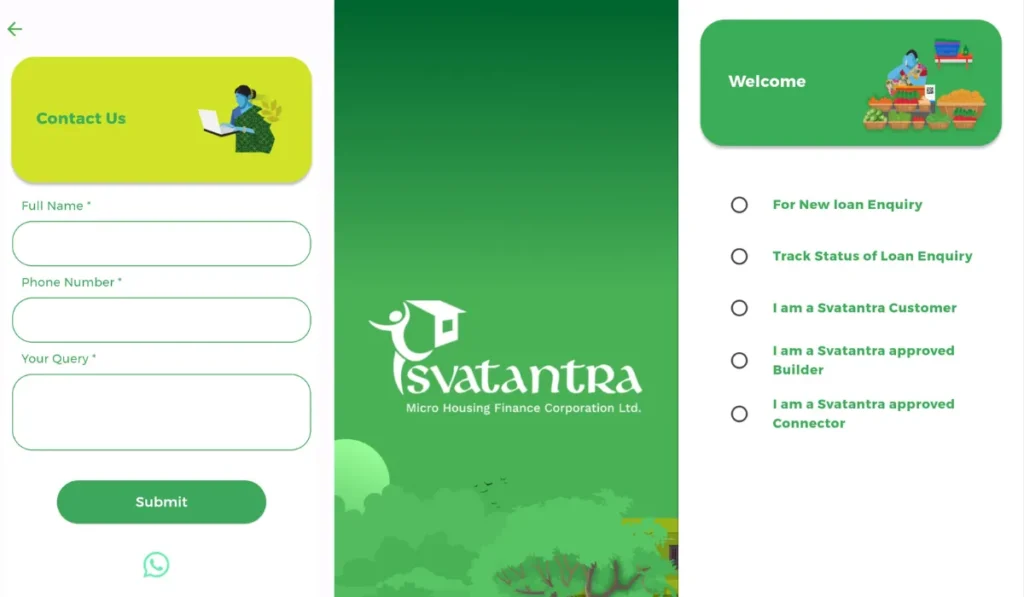

Customer Support

For assistance with your account or services, you can:

- Visit your nearest Svatantra branch

- Contact customer service through the mobile app

- Reach out through the official website

Also read – Leading Quick Commerce Companies in India in 2025

Financial Inclusion Impact

Svatantra’s commitment to financial inclusion has helped thousands of entrepreneurs across India access formal financial services. Their emphasis on digital solutions and financial education has created a sustainable model for microfinance that continues to empower small business owners and contribute to India’s economic growth.

Remember to regularly check your loan status and account details through the official Saathi Svatantra portal to stay updated on your financial commitments and available services.

FAQs

What is Saathi Svantra Microfin?

In India, Saathi Svantra Microfin is a microfinance organization that offers financial services to small enterprises and low-income individuals.

Documents are required for a Saathi Svatantra loan application?

To apply for a loan, you typically need:

– Valid government ID proof (Aadhaar card, PAN card, or voter ID)

– Recent passport-size photographs

– Proof of residence

– Basic KYC documents

– Business details or proof of income